[Source: Fiji Government/ Facebook]

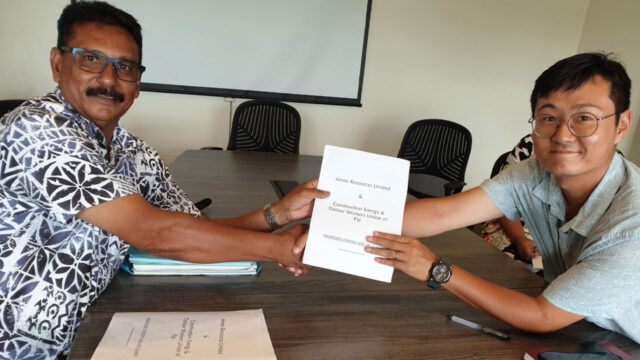

Deputy Prime Minister and Minister for Finance Professor Biman Prasad alongside Sarah-Jane Wild, Chair of the Pacific Catastrophe Risk Insurance Company (PCRIC), have signed a commitment letter for Fiji’s Parametric Insurance Product.

This agreement signing took place in Marrakech, Morocco yesterday.

Professor Prasad expressed his appreciation for PCRIC’s innovative approach in crafting a tailored, risk-focused product, marking a pioneering endeavor for Fiji.

As the cyclone season looms, this insurance product arrives at a critical juncture.

[Source: Fiji Government/ Facebook]

He states that Fiji is vulnerable to tropical cyclones, floods, and climate-related disasters, faces recurring infrastructure damage, livelihood disruption, and substantial financial burdens on the government’s budget.

He has emphasized the urgent need to allocate more funds from the government’s coffers for emergency response, climate-resilient infrastructure, and relocating populations affected by rising sea levels and loss of arable land.

In a strategic move to boost disaster risk financing, Fiji introduces its first-ever sovereign parametric insurance, the “Cat-in-a-Circle” product.

This insurance covers cyclones of Category 3 and above within specified coastal areas, including Viti Levu, Vanua Levu, Yasawa’s and Kadavu.

The potential coverage limit, ranging from US$9 million to US$10.5 million, is contingent on international reinsurer involvement, with a total premium of US$1.5 million.

The Deputy Prime Minister has emphasized that Fiji’s commitment to sovereign parametric insurance aligns with its objectives of aiding citizens after natural disasters, fortifying resilience, and safeguarding the nation’s financial stability in the face of disaster risks.

Fiji has been actively diversifying its disaster risk financing options, recently securing a concessional standby loan from the Japan International Cooperation Agency (JICA) tied to disaster declarations.

The government has also integrated the World Bank Catastrophic Drawdown Option (CAT DDO) into its disaster risk financing toolkit, ensuring swift disbursement in the aftermath of natural disasters.

Litia Cava

Litia Cava