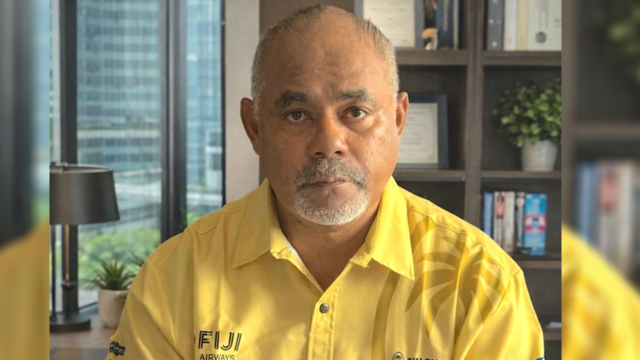

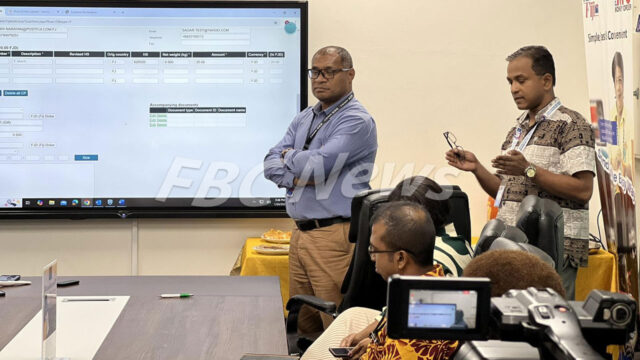

SOLE Fintech Founder Semi Tukana

Close to 360,000 Indigenous Fijians do not have bank accounts, says SOLE Fintech Founder Semi Tukana.

Therefore, he says that SOLE has created two innovative platforms to enhance the way money is saved and spent in rural communities.

SOLE Fintech is a social financial platform dedicated to providing fast, safe, and reliable financial tools to meet the needs of its members.

Tukana asserts that the SOLE co-op platform in particular holds great potential for assisting rural cooperatives.

“We will build Sole Co-op, which is a very simple point of sale, a very simple accounting ledger, a very simple inventory and pricing module, and a very simple share registry for cooperatives. So that it makes transactions more accountable.”

According to Tukana, the objective of this platform is to give rural cooperatives and canteens more authority by letting them create a distribution company that can effectively manage supplies from vendors through Sole Trader.

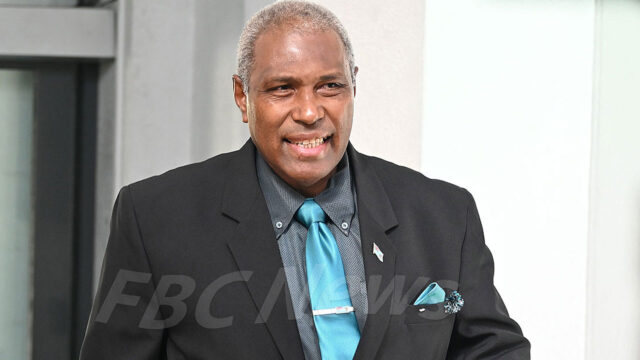

Lomaiviti Provincial Council Chair, Ratu Etueni Caucau, emphasizes the platform’s potential to serve the people of Lomaiviti given the province’s particular geographical constraints.

“This is a local effort, a local initiative. Nothing came from overseas. All the worries about cyber fraud and scams. They are well protected, as we hear today. They have a proven track record in the last 11 years.”

The people of Lomaiviti hope to benefit from more financial independence and better access to necessities as these platforms roll out.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Sivaniolo Lumelume

Sivaniolo Lumelume