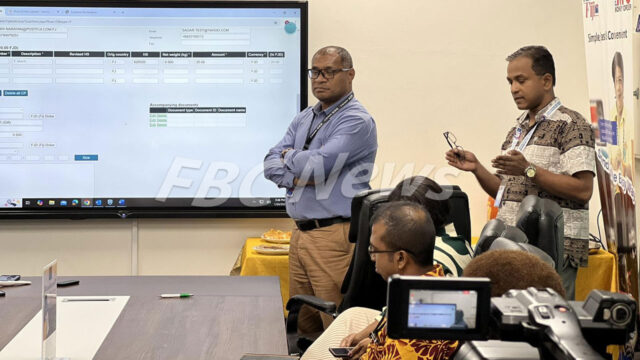

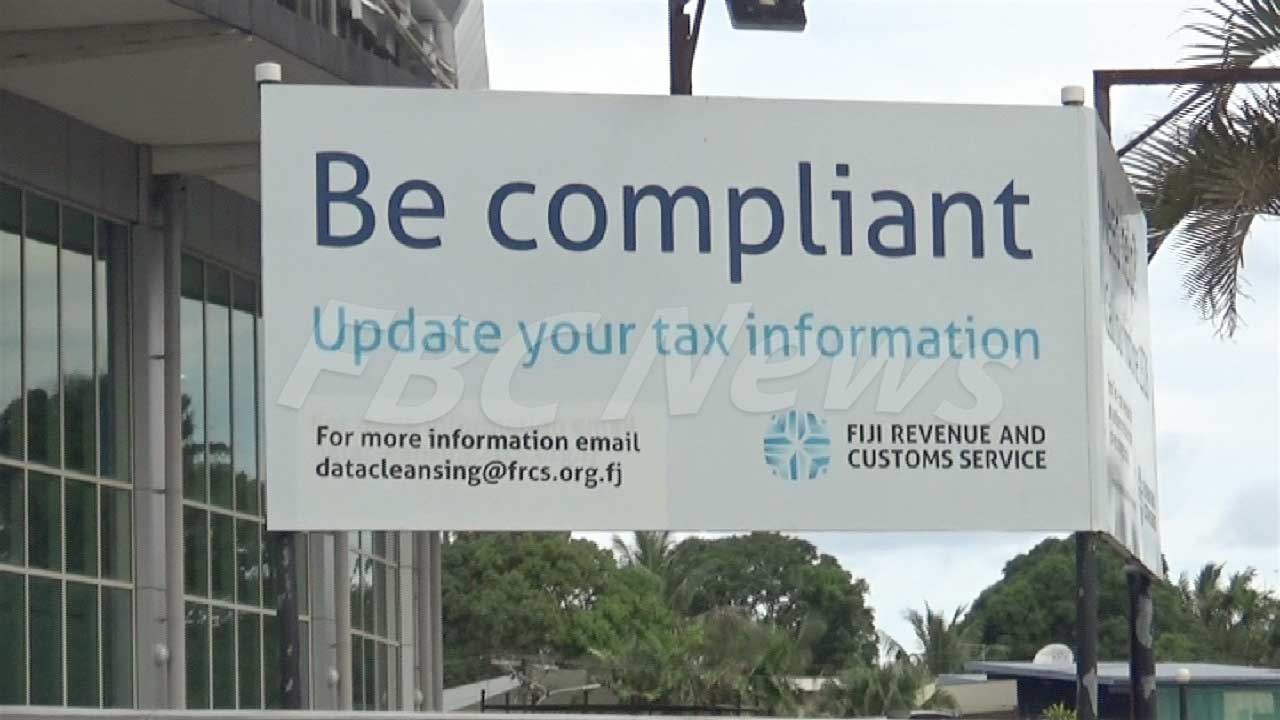

Fiji Revenue and Customs Service Chief Executive Udit Singh says the FRCS is aware of 2000 non-compliant businesses and has placed them under strict scrutiny.

Singh says the figure represents a significant number of businesses that are failing to follow regulations and comply with tax payments, resulting in the loss of millions in potential revenue for the government.

He highlights that, sadly, the majority of these non-compliant businesses are already part of the VAT Monitoring System, highlighting a severe oversight and abuse of the regulatory framework.

“There are quite a number of businesses, up to about 2,000, that are not following the rules as they should. We know who they are, and effectively, we will be corresponding with them to make sure that they comply.”

Singh says that these tax evaders span various segments, but the FRCS already possesses comprehensive information on them.

“These are businesses right across a lot of segments; they are by far noted in the VMS system; under the privacy rule, we probably can’t say who they are, but they are on the radar.”

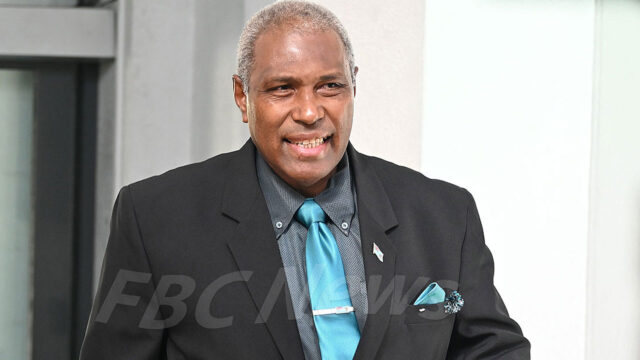

Finance Minister Professor Biman Prasad says he is deeply concerned about this widespread non-compliance, as it significantly undermines government revenue.

“There are a large majority of taxpayers in my view who are honest and who are compliant, but there is also a significant number who used means to avoid taxes, and those are the ones we will not tolerate; there will be penalties; there will be processes to deal with them.”

The Finance Minister warns that the FRCS will crack down hard on individuals and businesses, urging all taxpayers to comply with the law to prevent the issue from escalating further.

Stream the best of Fiji on VITI+. Anytime. Anywhere.

Apenisa Waqairadovu

Apenisa Waqairadovu